Welcome to our comprehensive guide on how to effectively use a financial calculator. Whether you are a seasoned professional or just starting your journey into the world of finance, understanding the ins and outs of this essential tool is crucial. Financial calculators have revolutionized the way we analyze and plan financial decisions, ranging from simple budgeting to complex investment strategies. In this informative article, we will delve into the functionalities and features of a financial calculator, equipping you with the knowledge and confidence to navigate through its various functions effortlessly. So, let’s dive in and unlock the power of this indispensable device.

Introduction to Financial Calculators

Financial calculators are powerful tools that can assist in making complex financial calculations quickly and accurately. Whether you’re a student, a business professional, or simply someone who wants to manage their personal finances more effectively, understanding how to use a financial calculator is essential. In this post, we will provide you with a comprehensive guide on how to make the most of this valuable tool.

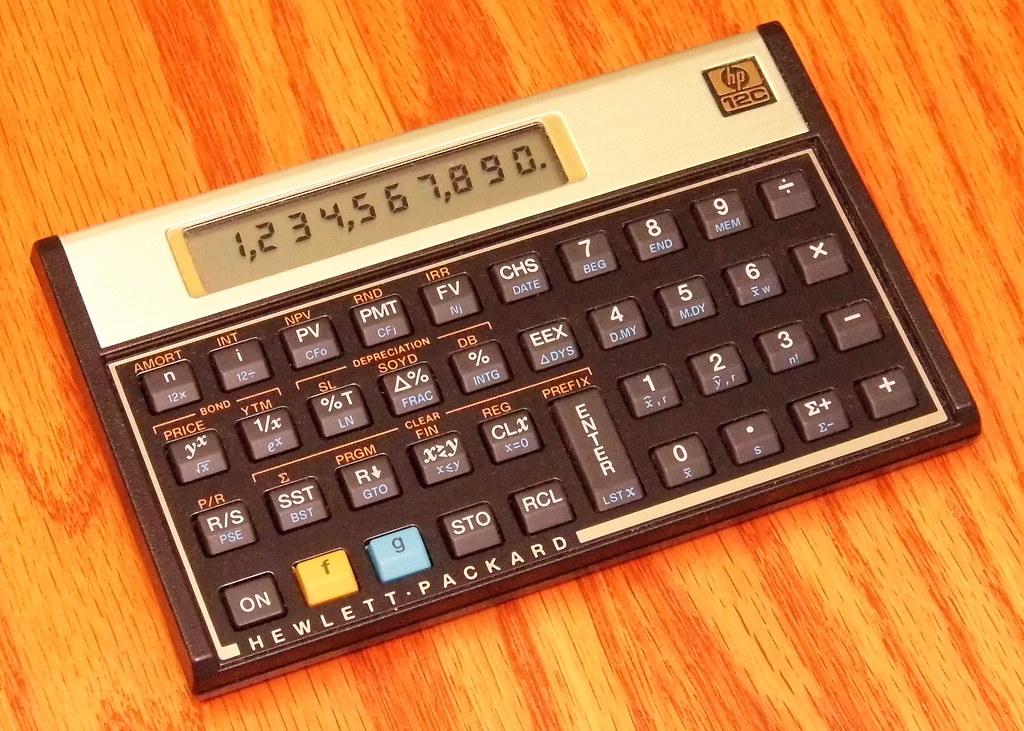

Firstly, it is important to familiarize yourself with the basic functions of a financial calculator. Most models come equipped with buttons for arithmetic operations such as addition (+), subtraction (-), multiplication (×), and division (÷). Additionally, you will find keys for percentages (%), negation (±), and memory (M+ and M-). Knowing how to use these fundamental operations will lay the foundation for more intricate calculations.

One of the most powerful features of a financial calculator is the ability to solve time value of money problems. These calculations involve determining the value of money over time, taking into account factors such as interest rates, compounding periods, and present and future values. By effectively utilizing the time value of money functions on your calculator, you can accurately evaluate investment opportunities, determine loan payments, and plan for retirement with ease.

Another essential skill is understanding how to calculate and interpret key financial ratios. This is particularly useful for analyzing the financial health of a company or making informed investment decisions. Popular financial ratios include the current ratio, debt-to-equity ratio, and return on assets. With your financial calculator, you can effortlessly input the necessary data and obtain instant results, enabling you to make well-informed financial decisions.

In addition to numerical calculations, many financial calculators also offer built-in functions to perform statistical analysis. This opens up a world of possibilities, as you can use the calculator to calculate means, standard deviations, correlation coefficients, and even perform regression analysis. These statistical features are invaluable when analyzing data sets, making forecasts, or conducting research in finance or economics.

Lastly, it is worth mentioning that financial calculators often come with additional features and capabilities such as currency conversions, tax calculations, and graphing functions. These advanced features can be incredibly useful in more complex financial scenarios. By exploring the user manual and experimenting with the various functions, you can unlock the full potential of your financial calculator and streamline your financial decision-making processes.

In conclusion, financial calculators are versatile tools that provide immense value in the world of finance. By understanding how to utilize their basic functions, time value of money calculations, financial ratios, statistical analysis, and additional features, you can make more informed financial decisions and save valuable time. So, grab your financial calculator, explore its functions, and empower yourself to take control of your finances.

Understanding the Functions and Features of a Financial Calculator

Financial calculators are powerful tools that can help individuals and professionals alike in their financial planning and analysis. With their wide range of functions and features, these calculators can quickly solve complex equations, making financial calculations a breeze. Whether you are a student, a business owner, or simply want to manage your personal finances more efficiently, is essential. In this post, we will delve into the world of financial calculators and explore how to use them effectively.

Basic mathematical functions: Financial calculators are equipped with all the basic mathematical functions you would expect, such as addition, subtraction, multiplication, and division. These functions come in handy when performing simple calculations like budgeting or calculating loan payments. With the calculator’s keypad, these functions can be easily accessed and used for quick calculations.

Time-value-of-money (TVM) calculations: One of the most powerful features of a financial calculator is its ability to perform TVM calculations. This feature allows you to solve complex problems involving interest rates, loan payments, and time periods. With just a few inputs, you can determine loan amounts, future values, and even the present value of investments. This makes financial planning, budgeting, and investment analysis much simpler and more accurate.

Amortization: Amortization is the process of paying off a loan over time with regular payments. Financial calculators have built-in functions that can help you calculate amortization schedules for various types of loans, such as mortgages or car loans. By inputting the loan amount, interest rate, and loan term, the calculator can generate a detailed schedule that shows the principal and interest payments for each period. This feature is especially useful when comparing different loan options or planning your repayment strategy.

Statistical analysis: Many financial calculators also come with statistical functions that enable you to analyze data sets and calculate various statistical measures. Whether you are a student studying finance or a business owner analyzing sales data, these functions can assist you in drawing meaningful conclusions from the data. From calculating means and medians to performing regression analysis, financial calculators can handle a wide range of statistical calculations.

Built-in financial formulas: In addition to the above functions, financial calculators often include pre-programmed financial formulas for specific applications. For example, you may find formulas for calculating present value, future value, net present value, internal rate of return, and more. These pre-programmed formulas can save you time and effort, as you don’t have to derive or memorize the formulas yourself. Simply input the relevant data, and the calculator will provide you with the desired result.

In conclusion, financial calculators are versatile tools that simplify complex financial calculations and assist in various financial decision-making processes. With their basic mathematical functions, TVM calculations, amortization capabilities, statistical analysis tools, and built-in financial formulas, these calculators offer a wide range of functions and features for users to explore. By mastering the functions of a financial calculator, you can enhance your financial literacy, make informed decisions, and efficiently manage your personal or business finances.

Step-by-Step Guide to Performing Basic Financial Calculations

Financial calculations are an important aspect of managing your personal finances. Whether you are budgeting, saving for a goal, or making investment decisions, having the right tools and knowledge is crucial. One such tool that can greatly simplify these calculations is a financial calculator. In this post, we will guide you through the steps of using a financial calculator to perform basic financial calculations.

Step 1: Familiarize Yourself with the Calculator

The first step in using a financial calculator is to get to know its functions and buttons. Take a moment to read the user manual provided by the manufacturer. Understand the purpose and function of each button, from numeric keys to specific financial functions. Some calculators may have built-in functions for interest calculations, cash flows, and other financial functions, while others may require you to enter formulas manually.

Step 2: Determine the Calculation You Need

Identify the type of financial calculation you need to perform. Financial calculators are capable of handling various calculations, such as compound interest, loan amortization, present value, or future value calculations. Understanding the specific calculation you require will help you navigate the calculator effectively and enter the correct inputs.

Step 3: Enter the Relevant Values

Once you know the specific calculation you need, it’s time to enter the relevant values into the calculator. For example, if you are calculating compound interest, you will need to enter the principal amount, interest rate, compounding period, and the time period. Be sure to double-check the values you enter to avoid any errors.

Step 4: Perform the Calculation

After entering the values, it’s time to perform the calculation. Depending on the financial calculator you are using, you may need to press specific function keys or follow a series of steps to obtain the result. Some calculators may provide you with the option to compute the result instantly, while others may require you to press multiple keys to obtain the final answer.

Step 5: Interpret and Apply the Results

Once the calculation is complete, it’s important to interpret and apply the results. Take the time to understand what the calculated value represents and how it relates to your financial goal or decision. For example, if you calculated the future value of an investment, consider whether the potential returns align with your investment objectives.

Overall, using a financial calculator can simplify the process of performing basic financial calculations. By following these step-by-step guidelines and familiarizing yourself with the calculator’s functions, you can confidently tackle a wide range of financial calculations with ease.

Advanced Techniques for Utilizing a Financial Calculator

Now that you have a basic understanding of how to use a financial calculator, let’s delve into some advanced techniques that can help you make the most of this powerful tool. With these advanced techniques, you’ll be able to perform complex calculations and analyze financial data with ease.

1. Net Present Value (NPV) Calculation

One of the most useful features of a financial calculator is its ability to calculate the net present value of cash flows. To do this, enter the cash flows into the calculator, along with the appropriate discount rate. The calculator will then provide you with the NPV, allowing you to determine the profitability of an investment or project.

2. Internal Rate of Return (IRR) Calculation

Calculating the internal rate of return can be a challenging task, but with a financial calculator, it becomes a breeze. Simply enter the cash flows and press the IRR button. The calculator will then give you the IRR, which represents the discount rate at which the net present value of the cash flows is zero.

3. Amortization Schedule Creation

If you’re dealing with loans or mortgages, a financial calculator can help you create an amortization schedule. Enter the loan amount, interest rate, and loan term into the calculator, and it will generate a detailed schedule showing the payment amounts, principal and interest breakdown, and remaining balance for each period.

4. Time Value of Money (TVM) Calculations

The time value of money is a fundamental concept in finance, and a financial calculator can handle TVM calculations effortlessly. Whether you need to calculate future or present values, interest rates, or number of periods, a financial calculator can quickly provide you with accurate results, saving you time and effort.

5. Statistical Analysis

Beyond traditional financial calculations, many modern financial calculators offer advanced statistical analysis capabilities. You can compute mean, standard deviation, correlation coefficient, and regression analysis to analyze financial data and make informed decisions. These tools are incredibly useful for investment analysis, risk management, and forecasting.

Tips and Tricks to Maximize Efficiency and Accuracy with a Financial Calculator

Using a financial calculator can greatly simplify complex financial calculations and save you valuable time. To help you get the most out of your financial calculator, we have compiled a list of tips and tricks that will enhance your efficiency and accuracy. By utilizing these techniques, you can make the most informed decisions and achieve your financial goals with ease.

1. Familiarize Yourself with the Function Keys

A financial calculator has numerous function keys that perform specific calculations. Take some time to understand the purpose of each key and its corresponding function. By knowing the capabilities of your calculator, you can quickly select the appropriate keys and avoid any errors.

2. Master the Time Value of Money Functions

The time value of money is a fundamental concept in finance, and most financial calculators provide specific functions to solve time value of money problems. Practice using these functions to calculate present value, future value, interest rates, and loan payments. Once you have a solid understanding of these functions, you can effortlessly solve complex financial problems involving loans, mortgages, and investments.

3. Utilize Shortcut Functions

Many financial calculators offer shortcut functions that allow you to perform multiple calculations at once. For example, you can use the amortization function to calculate both the monthly payment and the total interest paid on a loan. By using these shortcut functions, you can save time and reduce the risk of making calculation errors.

4. Understand and Adjust the Decimal Point Placement

The decimal point placement on your calculator is crucial for accurate calculations. Ensure that your calculator is set to the appropriate decimal place so that you don’t introduce errors in your results. Take the time to review your calculations and verify that the decimal point is correctly placed in your answers.

5. Double-Check Your Entries

Even with a financial calculator, it is crucial to double-check your inputs and outputs. Mistakes in data entry can lead to incorrect results. To minimize errors, always review your inputs before hitting the calculate button, and compare the output with your expectations. By double-checking your entries, you can have confidence in the accuracy of your calculations.

| Calculator Model | Price | Advanced Functions | Screen Size |

|---|---|---|---|

| Calculator A | $50 | Yes | 2.4 inches |

| Calculator B | $80 | Yes | 3.2 inches |

| Calculator C | $70 | No | 2.8 inches |

Remember, practice makes perfect. Spend some time exploring your financial calculator’s functions and features. By mastering its capabilities, you can improve your efficiency and accuracy in performing financial calculations. Incorporate these tips and tricks into your routine, and watch your financial decision-making become easier and more effective.

Q&A

Q: What is a financial calculator?

A: A financial calculator is a specialized device designed for performing complex calculations related to finance and investing. It helps individuals and professionals solve various financial problems, including determining loan payments, calculating interest rates, and analyzing investment returns.

Q: How does a financial calculator work?

A: Financial calculators use built-in formulas and functions to compute various financial variables. They are equipped with specific keys and buttons that enable users to input relevant information such as interest rates, payment amounts, time periods, and more. By entering this data, the calculator provides accurate results for different financial scenarios.

Q: What are the key features of a financial calculator?

A: Financial calculators generally include features such as time value of money calculations, present and future value calculations, internal rate of return (IRR), net present value (NPV), loan amortization, and depreciation calculations. These built-in functions simplify complex financial calculations and provide users with accurate results.

Q: How can I use a financial calculator to calculate loan payments?

A: To calculate loan payments using a financial calculator, you need to input the loan amount, interest rate, and loan term. Then, using the appropriate function like the PMT (Payment) function, the calculator will display the regular payment amount you need to make over the loan term.

Q: Can a financial calculator be used to calculate compound interest?

A: Yes, financial calculators are excellent tools for calculating compound interest. By entering the principal amount, interest rate, and time period, you can utilize the built-in functions to determine the future value of an investment or loan over time, taking into account compounding interest.

Q: How can a financial calculator help with investment analysis?

A: A financial calculator can assist in investment analysis by calculating essential metrics such as net present value (NPV), internal rate of return (IRR), and payback period. These calculations help in evaluating the profitability and viability of investment opportunities and aid in making informed financial decisions.

Q: Are there any tips for effectively using a financial calculator?

A: Yes, here are a few tips to make the most of your financial calculator: familiarize yourself with the calculator’s functions, learn key shortcuts, refer to the user manual for detailed instructions on specific functions, keep track of units and decimal places, and always double-check your inputs before performing any calculation.

Q: Can I use a smartphone app instead of a physical financial calculator?

A: Absolutely! Many smartphone apps offer financial calculator functions, providing the same benefits as a physical calculator without the need for an additional device. These apps are often convenient, easily accessible, and offer a user-friendly experience for performing financial calculations on the go.

Q: Where can I learn more about using a financial calculator?

A: To learn more about using a financial calculator, you can refer to the user manual that comes with your calculator. Additionally, there are numerous online resources, video tutorials, and educational platforms that provide step-by-step guides and interactive lessons on using financial calculators effectively. In conclusion, a financial calculator can be a valuable tool in making informed financial decisions. With its array of useful functions and easy-to-use interface, anyone can master the art of financial calculations. Whether you are a student, a business professional, or a budget-conscious individual, understanding and utilizing a financial calculator can greatly enhance your financial literacy and assist you in achieving your monetary goals. By following the step-by-step instructions provided in this article, you should now have a good grasp of how to use a financial calculator effectively and efficiently. Remember, practice is key – the more you familiarize yourself with the features and functions, the more proficient you will become in utilizing its full potential. So go ahead, tap into the power of financial calculations and take control of your financial future today!